The main argument facing borrowing from the bank of a good 401(k) try missing investment return. The money borrowed is paid with a fixed amount of notice in lieu of a possibly large return off inventory and thread opportunities. Although this is theoretically true with the attract repayments towards 401(k) money, it conflict try still irrelevant. Financing is paid down that have just after-income tax cash it doesn’t matter if they are 401(k) loans otherwise bank loans (mortgage and home collateral loans try exclusions). Likewise, money in the an effective 401(k) is actually taxed at detachment regardless of whether the earnings come from assets in the Black loans brings otherwise securities or away from a loan towards account owner (earnings aren’t taxed with Roth 401(k)s).

The appropriate issue is the newest riches huge difference at the conclusion of the borrowed funds. Nonetheless they concluded that 401(k) funds was a fair source of borrowing if debtor are liquidity restricted. A final argument against 401(k) financing is that they are accustomed to improve usage in lieu of to include an alternative for other financial obligation. Beshears, Choi, Laibson, and you will Madrian (2011), having fun with annual investigation regarding the Questionnaire off Consumer Funds, included in some age one around 33 per cent borrow off the 401(k) purchasing otherwise increase a property; doing 23 per cent get a motor vehicle and other tough good, or over so you’re able to 16 % purchase studies otherwise scientific expenses. Utkus and you can Younger (2010) revealed that young, reduced educated, and poorer individuals were expected to borrow off their 401(k). Li and you can Smith (2008) found that of several homes with a high rate of interest credit debt do not use using their financing-eligible 401(k). Borrowing so you’re able to retire large-rate personal credit card debt that has been incurred due to a sad experience could be a sensible choice. But not, in the event that credit card debt stems from bad decisions otherwise reckless using, economic guidance is normally needed to make sure the borrower could make better behavior later on. A borrower which will continue to explore credit cards irresponsibly once borrowing from the bank to blow all of them of have been around in worse monetary reputation.

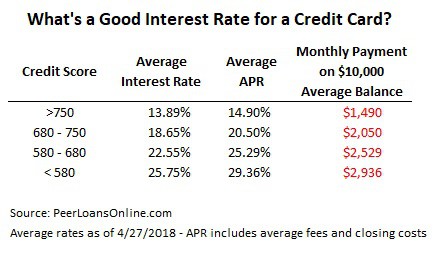

I establish findings the rate of interest as well as the investment get back will be important points influencing the latest 401(k) financing possibilities. The appropriate rate of interest is the rate that would be paid in the event that an effective 401(k) loan wasn’t made use of. The rate from an excellent 401(k) loan is typically less than the interest rate out-of equivalent funds. The difference in the costs brings savings to your borrower. The possibility to your borrower is whether the brand new money come back is actually anticipated to feel higher than a reduced offered markets rate. Whether your capital return is expected is higher, an effective 401(k) mortgage is an awful options.

Beshears, Choi, Laibson, and you may Madrian (2008) revealed that the result out-of 401(k) funds into the resource accumulation is minimal

Whilst interest rate and the resource come back may be the very points, other variables normally dramatically reduce the benefits associated with 401(k) finance. Origination costs, fix charges, measurements of the mortgage, in addition to come back towards the offers is relevant products that need in order to qualify. Desk 1 summarizes this new conditions that mean whether a good 401(k) loan is appropriate.

Circumstance Study

Next data explores whether or not the choice in order to obtain out-of good 401(k) is preferable to borrowing from the bank of a bank or other financial institution during the business pricing. The assumption is that there is a need to borrow money. The number of choices is auto loans, almost every other inevitable costs, and you may paying down credit card or any other highest desire-rate obligations. The analysis begins with assumptions favorable in order to 401(k) fund. The newest design uses five products: (1) the fresh new 401(k) financing rate; (2) the bank loan rates; (3) new limited tax rate; and you may (4) the latest funding come back or the go back for money invested in the newest 401(k). Next presumptions have been made from the analysis: